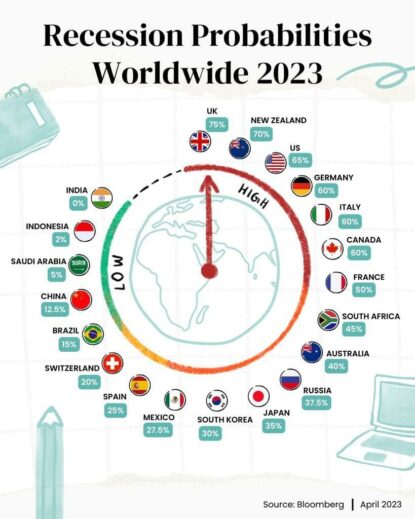

If we observe the red line which is pointing to UK, it is clear indication that UK being the most probable nation that may get into recession according to bloomberg report.

Why UK is the major economy set to shrink in 2023?

- Inflation is hitting the roof, it is at 40-year highs

- Did not bounce back from pandemic and people are fighting daily to tune with the cost of living crisis

- Energy prices are soaring after Russia Ukraine war, UK is also badly hit by that

- Money priniting in US made weaker economies much more weaker, indirectly US is exporting inflation

- Central bank on the other hand rising interest rates to cool the inflation but it doesn’t seem to work out in UK

- Where as in US, unemployment rate is multi year low. UK unemployment rate is still high.

How is India positioned in 2023?

- Every time US gets into a recession, 5 year and 10 year bond yields will come down in US because FED drops interest rates

- US is also consumer of oil like us, oil prices will see a dramatic decline of 40 to 50%

- India will get cheap oil as we are net importer of crude oil

How can we prepare ourself in these hard times?

- Have an emergency fund which feed your family 6 to 12 months

- Reduce unnecessary spendings like subscriptions

- Don’t over leverage yourself if you are buying high ticket items like real-estate

- Try to move into a city which has low cost of living

- Sit with cash to grab enough opportunuties when market provides

- Try to drive multiple sources of income and enhance your skills if you are in job market

- Business trends are also changing a lot post digitalization, check how much effective returns you are making on the deployed capital after tax cuts and operational expenses

- Don’t play with penny stocks at this juncture, half of them will go bankrupt due to rising interest rates