If you are Indian investor who wanna diversify your bets spreading across global equities or if you are from USA who wanna park your funds in equities, this will help you for sure !!

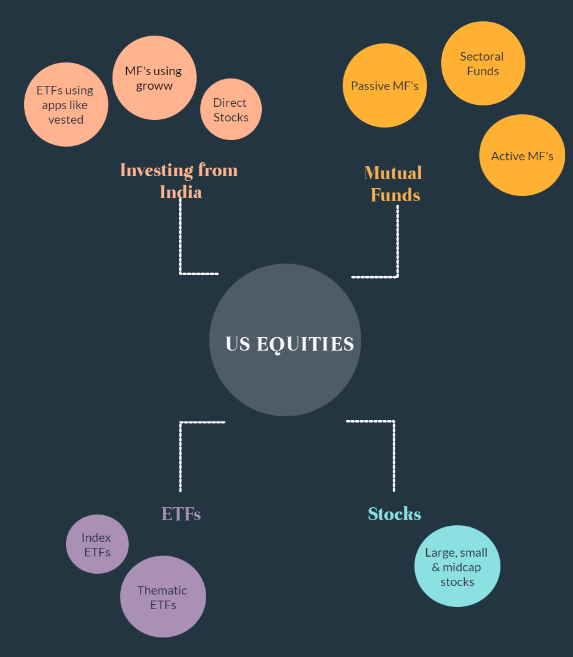

When we get into equities, broadly we have 3 choices left to park our funds.

- Direct Stock Picking

- Mutual Funds

- ETFs

Let us deep dive into each of these things and understand the pros & cons

If you are beginner having less amount of money to do SIP every month, go with index ETFs. If you wanna bet a sector, check sector ETFs.

If you have seen the markets a bit and understand which companies will stay in the growth cycle, invest in some direct stocks it might be 20-30% of portfolio, remaining money can be parked in ETFs or mutual funds depending on the size.

If you are pro who have been involved in the market since many years and if you are beating the benchmark returns, then kudos, go with direct stock picking but check out funds where they park money in 100 different companies to reduce risk. So that 80% of your portfolio can be direct stock picking, other 20% you will be taking diversified bets using mutual funds or ETFs.

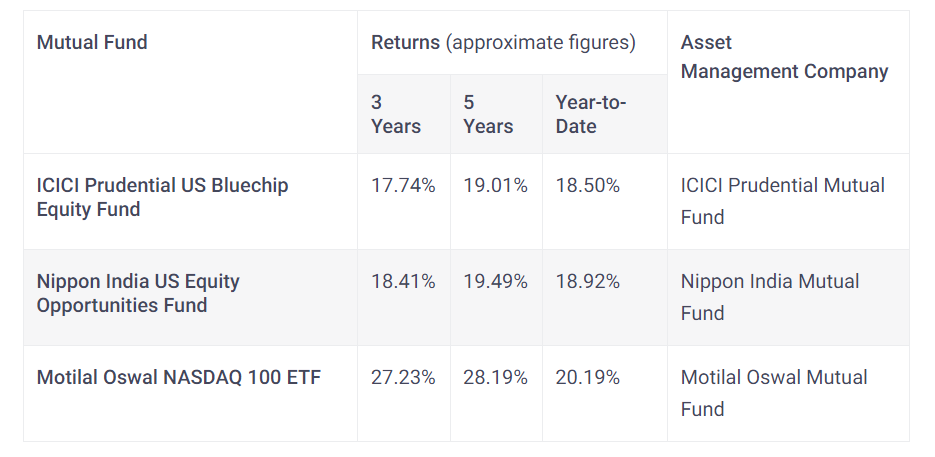

Here is the list of ETFs

If you want to invest in top 500 companies in USA, pick S&P 500 ETF.

If you want to invest direct stocks, choose the sector and bet on 3 to 4 stocks atleast in that sector. If you are betting on Largecap IT, then pick Meta, Google, Microsoft..

Based on the style, amount and duration of investments, choose and diversify the bets.

If you are investor in India and you wanna park some of your funds, pick any mutual fund or invest in direct stocka via vested or any other broker,

Source: Groww