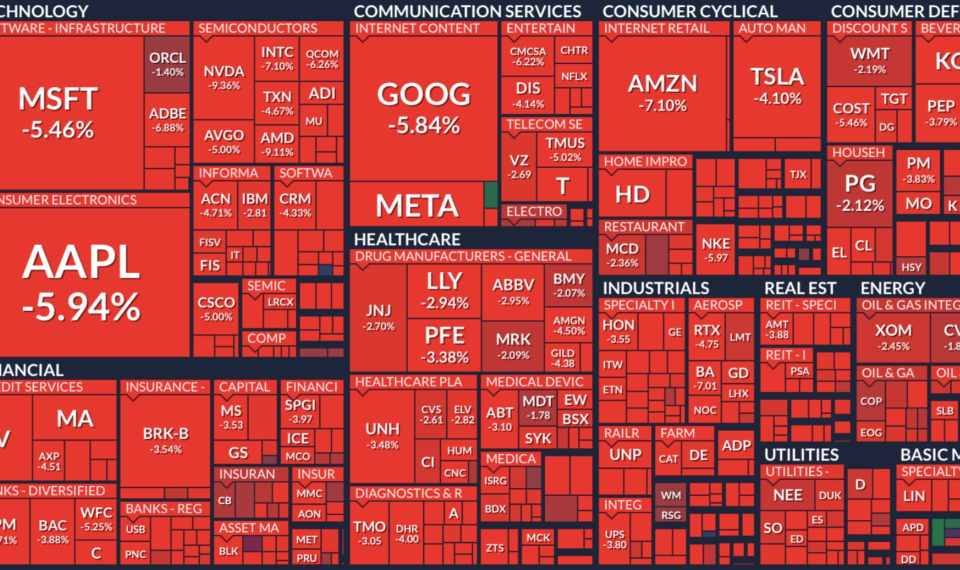

It’s the worst fall in the US market after COVID crash. Many biggies like Warren Buffet are sitting on huge cash piles, What’s your plan ??

- Recession bells started ringing in the US

- Japan market is falling like there is no tomorrow

- China market is struggling since couple of years

- In India, major banks are facing deposit issues, steam is not there in most of the stocks

Do you think Bears are back ??

Where it all started ??

Bank of Japan raises interest rate 0.25% suddenly, due to this Japan’s Yen currency got strengthened. Japan companies which earn in terms of dollars based on Yen (just like our Indian IT & Pharma companies which get revenues in terms of dollars)

Since Yen got strengthened, whatever the outflow of money happened to different global markets from Japan in earlier years, it is moving back to pavilion, coming back to Japan market again. This triggered sudden sell off.

At the same point, data points in the USA like unemployment data, manufacturing data aren’t good. US markets started falling. So, entire markets started falling. Hope you got the clear picture now ??

Unemployment is increasing in USA, new jobs are not adding at the same pace. Wage hikes are so minimal. Economic slowdown might be knocking our door.

Takeaways

- US Federal Reserve is expected to cut rates in September, rate cuts is positive for the market but some of the positivity is already priced in the market

- If rate cuts aren’t happening, that is huge negative to the market. Keep an eye

- As an investor, always have some cash in hand to deploy whenever there is huge fall in your stocks.

- If you are sitting on mountain of small & midcaps, please exit.

- If you are sitting with bad companies or unsustainable valuations, it’s high time to rethink.

- If your companies have strong fundamentals & reasonable valuations, then fall might not effect you much.

- Have strict stop loss if you are short term investor, have some cash if you are long term investor, exit crap from your portfolio.

- If you wanna enter the market, keep your orders ready at major supports. Don’t invest fully at a time, invest in phased manner for every 5-10% fall.

- Low risky investors can directly go with Nifty 50 index funds at good demand zones, don’t jump in right away, please check the price action.

- Wait for your levels, deploy your funds, invest right & sit tight !!