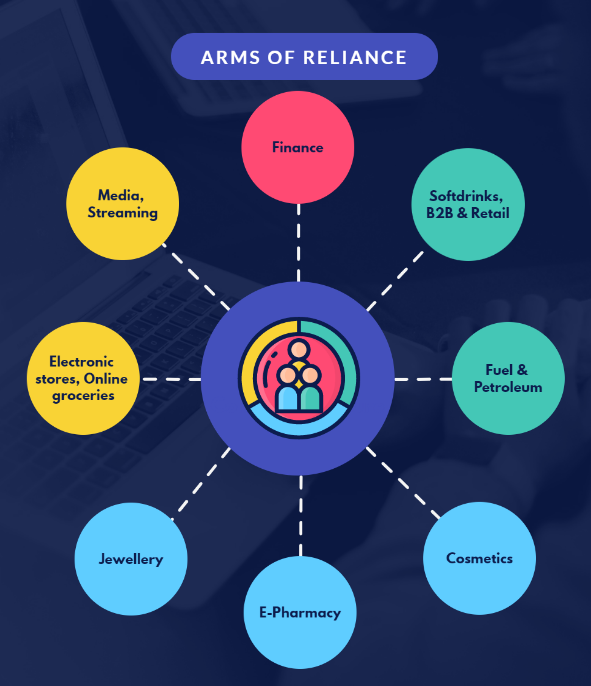

Mukesh Ambani’s Reliance Jio is making bold moves across India’s top industries. He is acquiring one industry in at a time and keeps the customer on his own side.

Jio 4G disrupted Indian telecommunication industry and killed many players, but customers love it!

Jio TV is now taking over Indian OTT with free IPL, almost killed Hotstar, but customers love it!

This is crazy, but it’s happening!

Here’s a snapshot of how they’re taking on the biggest players targeting the largest market share:

📈 Finance – Jio Financial Services vs Bajaj Finance

Market Size: $350B | Growth: 22% | Leader: Bajaj Finance (30%)

🥤 Soft Drink – Campa Cola vs Coca-Cola

Market Size: $8B | Growth: 9% | Leader: Coca-Cola (40%)

💄 Cosmetics – Tira vs Nykaa

Market Size: $20B | Growth: 15% | Leader: Nykaa (25%)

👗 Clothing – Ajio vs Myntra

Market Size: $70B | Growth: 12% | Leader: Myntra (35%)

🎬 Streaming – JioCinema vs Hotstar

Market Size: $1.6B | Growth: 29% | Leader: Hotstar (30%)

💊 E-Pharmacy – Netmeds vs PharmEasy

Market Size: $18B | Growth: 21% | Leader: PharmEasy (25%)

🎶 Music Streaming – JioSaavn vs Spotify

Market Size: $500M | Growth: 28% | Leader: Spotify (30%)

💍 Jewellery – Reliance Jewels vs Tanishq

Market Size: $60B | Growth: 11% | Leader: Tanishq (10%)

🏬 Private Labels – Reliance Retail Consumer Brands vs HUL

Market Size: $70B | Growth: 14% | Leader: HUL (30%)

🛒 Retail – Reliance Retail vs Dmart

Market Size: $1T | Growth: 10% | Leader: Dmart (15%)

🏢 B2B Marketplace – JDMart vs IndiaMART

Market Size: $10B | Growth: 19% | Leader: IndiaMART (40%)

📱 Electronic Stores – Reliance Digital vs Croma

Market Size: $15B | Growth: 16% | Leader: Croma (20%)

⛽ Fuel and Petroleum – Jio-BP vs IndianOil, BPCL

Market Size: $120B | Growth: 5% | Leader: IndianOil (35%)

🍏 Online Groceries – Jio Mart vs BigBasket

Market Size: $3.5B | Growth: 25% | Leader: BigBasket (35%)

📺 Media – Network18 vs Zee, Sony

Market Size: $12B | Growth: 10% | Leader: Zee (25%)

With this speed, Ambani is becoming Industry God of India!

5 years from now…

- You’ll wake up on a comfy bed from Reliance Retail

- Slip into Jio slippers ordered from Ajio

- Make breakfast with Jio Mart groceries

- Listen to morning bhajans on JioSaavn

- While eating breakfast, catch the latest news on Network18

- As you head out to work, fuel up your car at a Jio-BP station

- Work in a company acquired by Reliance

- By evening, you’re watching IPL on JioTV

- Drinking Campa Cola with snacks

- After dinner, take medicines from Netmeds

Then you sleep, dreaming of becoming Ambani one day!

Source: Twitter

Takeaways:

- Yes, No wonder as you see Reliance is trying to spread its wings but don’t just jump on to click buy button, every company has downside too

- Problem with Reliance is, it is not an ONGC company, it is not a Media company, it not a retail company. It is trying to become one stop place for everything which is next to become impossible.

- When your bets are widespread, vision becomes blurry in the long run. It is very hard for an individual to gain mastery over multiple skillsets. This is the same problem in an organization level company will face.

- If it is very good company which has great growth prospects, why Foreign institutional investors are reducing their stake in the past year

- Even though it has many verticals, still ROCE is in the range of 9-10% which is not super attractive

- Price to earnings ratio of Reliance is bit high when compare to the sector P/E

- There was a time for Reliance share which remained flat for straight 5-6 years with 0% returns almost.

- It’s not always numbers, need to check how much pricing power the company has and what segment of the people the company is targetting.

Awesome Content

Thankyou

“5 years from now..” that content was well said, showing future reality.

Haha. thankyou buddy !!