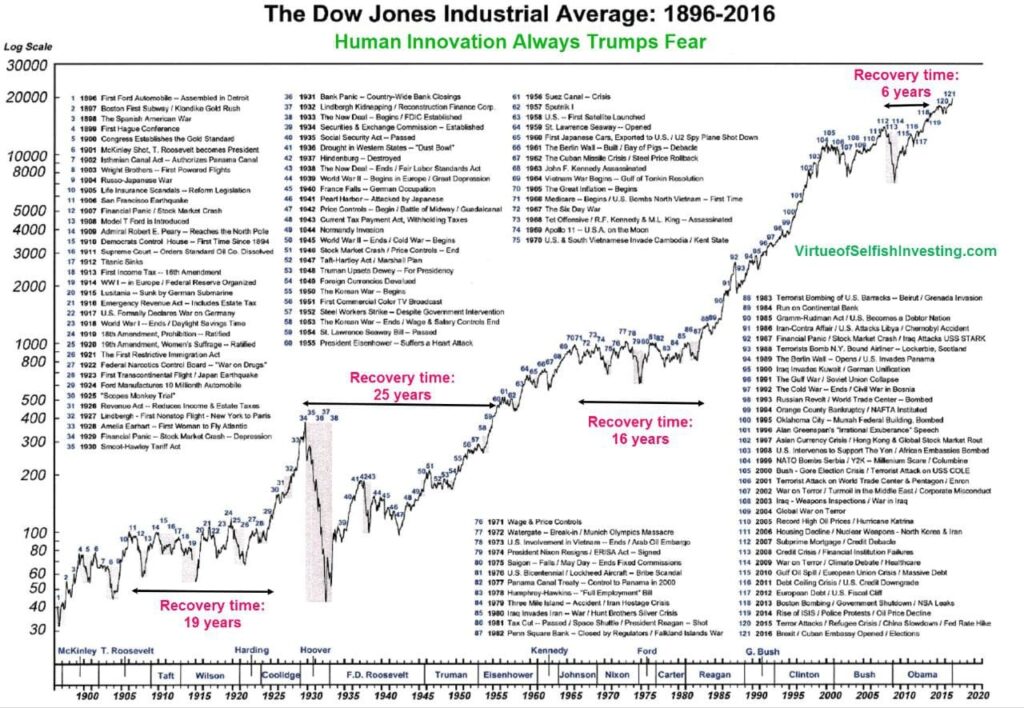

Let us understand how typically crests & troughs of the market generally works by observing the following picture as an example

One thing is very clear market has 2 phases, bull phase & bear phase. If market corrects more than 20% from the top, then it is considered as bear phase. So, we are no way near to the bear phase now. All the bearishness is only short term, long term bullish trend is still intact when we take year 2024 as an example w.r.t. Indian Market.

Market will fall when there is negativity & when there is uncertainty. Let’s understand the difference between two in the world of stock market, 2020 COVID crash & 2008 Financial Crisis, all these type of things create uncertainty in the market. We never know what’s the next thing that gonna happen, at that uncertain times markets react violently & give a bigger correction which we generally call as crash.

If you take an example of Russia Ukraine War, market corrected at that time around 2500 points in Nifty within span of couple of days but since people or market knows that negativity will end eventually as time ticks away, slowly markets start pricing in the negativity. At that situations, market falls but the correction is not more than 20%. Most of the time, it gives around 10% dip & then fresh rally starts. These type of pullbacks or small corrections are necessary & considered as healthier for the upcoming rally.

Key points:

- Market is not in down trend, up trend is still intact but it is in correction or pullback mode.

- Invest in phased manner if you are investing, for every 10% fall from the top, pull the money & add it into the market. Turn of your brain for a while.

- Don’t do bulk buying with full quantity at a time, sit with some cash like Warren Buffet is sitting. It’s not the time to be 100% invested in the market, there is more fall expected if things don’t turn well or if rate cuts don’t happen as expected but this fall is temporary.

- If you are holding already runaway theme stocks like defense or railways, it is high time to exit or add strict stop-loss following the technical analysis.

- If you are low risk investor, simply buy index funds or ETFs in phased manner.

- If you are medium risk investor, you can play with stocks as well or do theme based investing in the undervalued sectors.

- If you are high risk investor, consider having some allocation in Crypto as well & look out opportunities from the unlisted space. You can build some positions in the real-estate as well, just now received the news of indexation benefit changes from the government, which is positive news for the real-estate.

Sectors to keep on radar :

- Many holding companies are trading at good levels, keep an eye.

- Private banks like HDFC & Kotak are still at good valuations, consider adding them if your intact is long term, short term deposit issues are still there for banks & price volatility cannot be ruled out.

- Datacenter stocks are the new buzz in 2024, explore this sector, ADC India is one such example.

- Companies in terms of finance space did not move much in the recent times, even Bajaj brothers did not perform, check the valuations & add if those are comfortable for your risk appetite. Repco Home Finance also looks good in terms of valuations.

- Check companies like SBI cards which did not move from past few years & consider adding them, they will give run up either today or tomorrow. HUL is also one such company, check P/E once before adding.

- Stocks which are in the paint & related cycle industries will start moving once we see new projects are adding in real-estate, Asian Paints is one such example. I hear Sushil Decor stock in different places around the web, one can study the stock before entering.

- Simply check who are the promoters buying their own stocks from the open market in this fall & keep those stocks in your watchlist.

- It’s not about whether you have bought something in the fall or not, whether you have picked right sector & right stocks. Every time, there will not be broad based buying, all stocks don’t go up. Slowly you will start observing this, sector rotation will happen. Men & boys will be differentiated in the next bull run.

- Have proper plan, invest in phased manner, diversify across the sectors, pick your hero’s in that space & start deploying cash. If you don’t have patience or brains to do that, move on with index funds.

I’m not SEBI registered Analyst, please do your own diligence before investing or take suggestions from your financial advisor. The recommendations or suggestions are just for educational purpose.

Good content and it is very clear to understand for the people who are new.

Thank you for giving this knowledge and keep posting😊.

Thankyou so much